A new week is coming. This week is all about Ben Bernanke and he will say at his annual pain avoidance conference in Jackson Hole Wyoming.

Almost everything I have read this past weekend is how Bernanke can stop the stock slide with a simple statement. "I am embarking on QE3." The hope here is that Bernanke opens the door and embarks on another campaign to save speculators, stock traders, and insure that hedge fund honchos can justify 2 and 20. All of these guys are just hoping that more QE will save them from another round of margin liquidation. I can see and hear it now, John Paulson and David Tepper working the phones to their prime brokers. "Don't Sell Me Out! Don't you know that Bernanke is going to reliquify the markets?" This may be even a Carl Quintenia CNBC Special - "Inside The Beggars Pit." Maybe Rowdy Roddy Piper can co host?

The idea that another round of stimulus will stop the summer retreat in stocks is the current hope in financial circles. There is no hope in the stock market. Can someone please alert the financial elites?

I am sure that stocks will take it on the chin this week if no QE/further stimulus is announced. Why? Because at the moment that is the path of least resistance. In the current macro environment, which is a slowing economy, non existent job market, weak housing, and cascading consumer sentiment, stocks will have a difficult time finding bids. The economy is soft and we have an even softer President who is extremely disappointing. Obama has not figured out what is wrong with the economy a full 30 months into his Presidency.

In my opinion, Bernanke is going to have a difficult time selling another round of QE3 just a year after QE2 massively failed. Markets will be disappointed as Bernanke, Geithner, and Obama have few political bullets left. The higher CPI figures this past week will most likely pause any talk of QE. But then again, QE2 never really rallied commodity prices higher although Brian Sack (NYFED) seems to think that keeping "prices higher than they normally will be" is good policy.

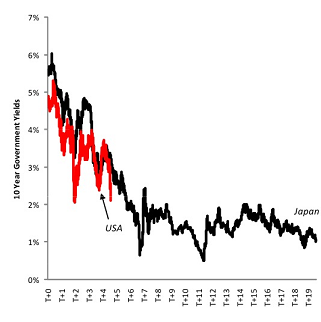

My hope is that no QE3 is announced. We need to make sure the market can stand on its own weight. The Fed since Greenspan has been delaying the pain for too long. We need to stop this dynamic Put insurance policy that protects asset prices. I am tired of the Greenspan/Bernanke Put. This is the root cause of all that is wrong with our financial system. We need to top putting band aids on wounds that need surgical procedures. We should have forced restructuring on the banks. We should have taken BOFA and Citigroup into pre packaged bankruptcy protection. We should have never allowed BOFA to buy Merrill Lynch. ML was insolvent the day BOFA plucked down tens of billions for that failed institution. It was bad/toxic money chasing insolvent money. We should not have allowed Wells to but Wachovia. Wachovia like Merrill should have been orderly liquidated thru bankruptcy. All of these failed institutions, Bear, Wamu, CountryWide, Wachovia, Merrill, and even Morgan Stanley should have been dismantled and put thru a pre packaged bankruptcy so that toxic assets were written down and cleansed from the banking sector. A fresh clean company then could have been floated. The only smart responsible thing that the Obama Administration has done so far were the Auto Bailouts. They would have been an excellent blueprint to deal with the banks. They would have saved the banking system and the economy if they would have just let these fraudulent and corrupt institutions die. Obama, Geithner, and Larry Summers should have gone Swedish instead of Japanese. Sweden cleansed their economy of failed institutions. Created good banks and toxic banks. Their economy took it on the chin for a few years but was growing soon after. We followed the Japanese method of pain avoidance.

Pain avoidance. Two words in the financial lexicon that needs to be purged. The Dow bottomed at 6500 when it became apparent that socialism would save the day. They should have instituted the Austrian School of policy. The markets would have gone to below 5K, but who cares. We would be much better off today. We would have taught these crooks a lesson. Instead we are back to square one. The same old problems. What we got in the form of policy was pain avoidance in September 2008, more of the same in 2009, and 2010 when QE2 was announced. The Obama Administration is so scared of the financial sector. So scared of getting Jamie Dimon upset.

What we have seen form Obama is an utter lack of understanding of how the economy works. As soon as Paul Volcker started talking about firing bank CEO's, Obama marginalized him. Why has Obama not listened to anyone who seems to know what they are doing? Volcker and Bill Black have been pleading with this ingrate over policy and the lack of prosecutions in the banking sector.

The reason we should not have any more stimulus is not because it is politically unfeasible or that it will stoke inflation, rather than that it doesn't work. Can it be that QE is a crappy policy that just sucks?

No amount of further QE will stabilize housing. No amount of further stimulus to prop up asset prices will get Americans off the unemployment line. QE1 and QE2 only temporally raised equity prices. Higher equity prices resulted in zero hiring and zero housing stabilization.

There is only one reason for Ben Bernanke to say no to QE3. It doesn't work.I doubt we will hear this from the mouth of Bernanke. If he actually utters these words then he is simply admitting that he knows what he is doing and that he has learned from his past mistakes. To bad that he has no clue what he is doing and has learned nothing from his past actions. The same can be said for Geithner and Obama.