In the past I have commented on the similarities between Japan's economy the last 20 years and the current malaise in the US Economy.

Like Peterman says.....Quick Elaine!....To the archives!

I said all the way back in June 2009 that US policy makers were making the same policy mistakes that the Japanese were making by not liquidating failing financial institutions and keeping a ZIRP in the midst of a balance sheet recession. Mind you the Japanese didn't immediately go to a ZIRP policy until a full 5 years after the implosion of the Nikkei. It was really policymakers that were worried about too much spending by the public sector that added to the problems with the Japanese economy. Also please note everyone says deflation when it comes to Japan but that really is a misnomer. Japan I believe only had one year when headline CPI was negative. It was just a balance sheet recession brought upon a massive credit bubble that needed to be extinguished. After they tried keeping the foot off the accelerator and curb stimulus spending is when the Japanese economy took the nose dive. We are headed in the same direction as Obama for whatever reason is in deficit reduction mode while the economy is still contracting. Pure lunacy.

Then I stated a few months later:

No Sex In The Champagne Room.

Then again in October 2009

There have been a lot of charts going around the Blogesphere talking about something I have been talking about for 2 years.

Lets go to the charts as Warner Wolf would say.

Courtesy - PragCap

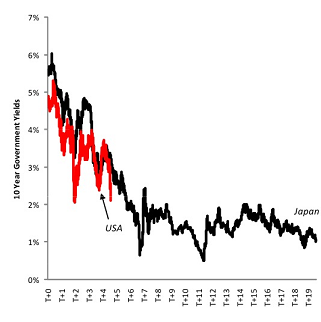

This is a chart of JGB Yields and US 10 Year Yields time overlapped. This wasn't pretty for the broader Japanese Economy and it doesn't bode well for ours.

At this rate 10 Year UST's will be between 1% & 1.5% in the very near future and staying down at those levels for quite some time. I think 10Y yields will be even lower because the US Economy is 2/3rds consumer driven which are only 10% through deleveraging. Also UST's are the most liquid investments in the world and the USD is the reserve currency. It is the global safe haven trade.

Both economies at the respective times were undergoing massive deleveraging. The Japanese economy was more of a corporate shrinking than ours where as its a consumer deleveraging.

What we have at the moment is a massive debt bubble that needs to unravel. This causes the economy to contract. We need government to make up for the contraction via spending to fill in the gaps. Unfortunately the country is run by the wholly trinity of idiots (Obama, Tea Party, and GOP), and I fear another long deep recession brought upon by this ill timed austerity. This means deflation and selling of risk assets into safe haven assets. Screw the ones who say stocks are cheap. They don't see the macro picture. The economy is weakening and stocks will look cheap looking in the rear view mirror.

I hope I am wrong but as long as Geithner,Bernake and Obama are running policy we are doomed.

This is also a gem of a chart.

Courtesy - Big Picture and Bloomberg Chart Of The Day

Causation doesn't mean correlation, but anyone who dismisses this chart better wear a helmet on the way down.

There are some differences in policy. US Central Bankers flooded the banking sector with free money while the Japanese waited a full five years but other than that I find many similarities.

And lastly this:

Courtesy - Angry Bear

Japan for all of their problems and issues are better off 20 years after their economy blew up. They at the time already had a very weak currency. The Yen was at 165 to the USD in 1990 when the Nikkei was at its highs. Their currency has appreciated from 165 all the way to 77 to the USD. This has greatly improved the Japanese way of life and increased their buying spending/buying power. In short the Japanese make stuff well and sell it better. They have a tremendous manufacturing base to which they can export out. The US economy which is owned and operated through the Corporate Kleptocracy has sold out its manufacturing base to the outside world. The only thing we export is inflation via QE and ZIRP and bad financial engineering. The USD will progressively get weaker which will hurt US Consumer spending/buying power.

Thus US Economy has to move to a strong dollar policy and do it quick or we face an extremely demoralizing economic future.

No comments:

Post a Comment